You didn’t train to become a therapist so you could spend hours each month hunting down receipts or puzzling over reconciliations. But clean financial records aren’t optional. They help you make informed financial decisions, reduce financial stress, stay compliant with tax authorities, and support ethical billing practices.

Good accounting software for therapists saves you hours each month and keeps your taxes predictable. This guide translates accounting jargon into language that makes sense for clinical practice. You’ll learn how to choose the right bookkeeping software, set it up properly, and run simple workflows that actually fit the rhythm of therapy work.

TL;DR

- Choose software that matches your practice model: Solo cash-pay therapists need different tools than group practices billing insurance

- Keep PHI out of accounting completely: Use client IDs or initials only, never diagnoses or session details

- Most therapists do best with QuickBooks Online or Xero: They balance power, ease of use, and CPA compatibility

- Software pays for itself fast: Even a $50/month tool saves you hours weekly, easily justifying the cost

- Start simple and integrate strategically: Connect your EHR, payment processor, and payroll but maintain clear boundaries between clinical and financial data

What Therapists Need From Accounting Software

Core features that matter in clinical practice

Bank feeds and fast reconciliation. Your accounting software should automatically import transactions from your bank accounts and credit cards. This cuts manual data entry time dramatically and reduces human error. You’ll spend minutes instead of hours matching client payments to invoices.

Automated expense categorization and rules. After you categorize a vendor once, the software should remember it. Set up rules so your EHR subscription always goes to software expenses and your liability insurance always lands in the right category. Consistency matters for accurate financial reports and easier tax preparation.

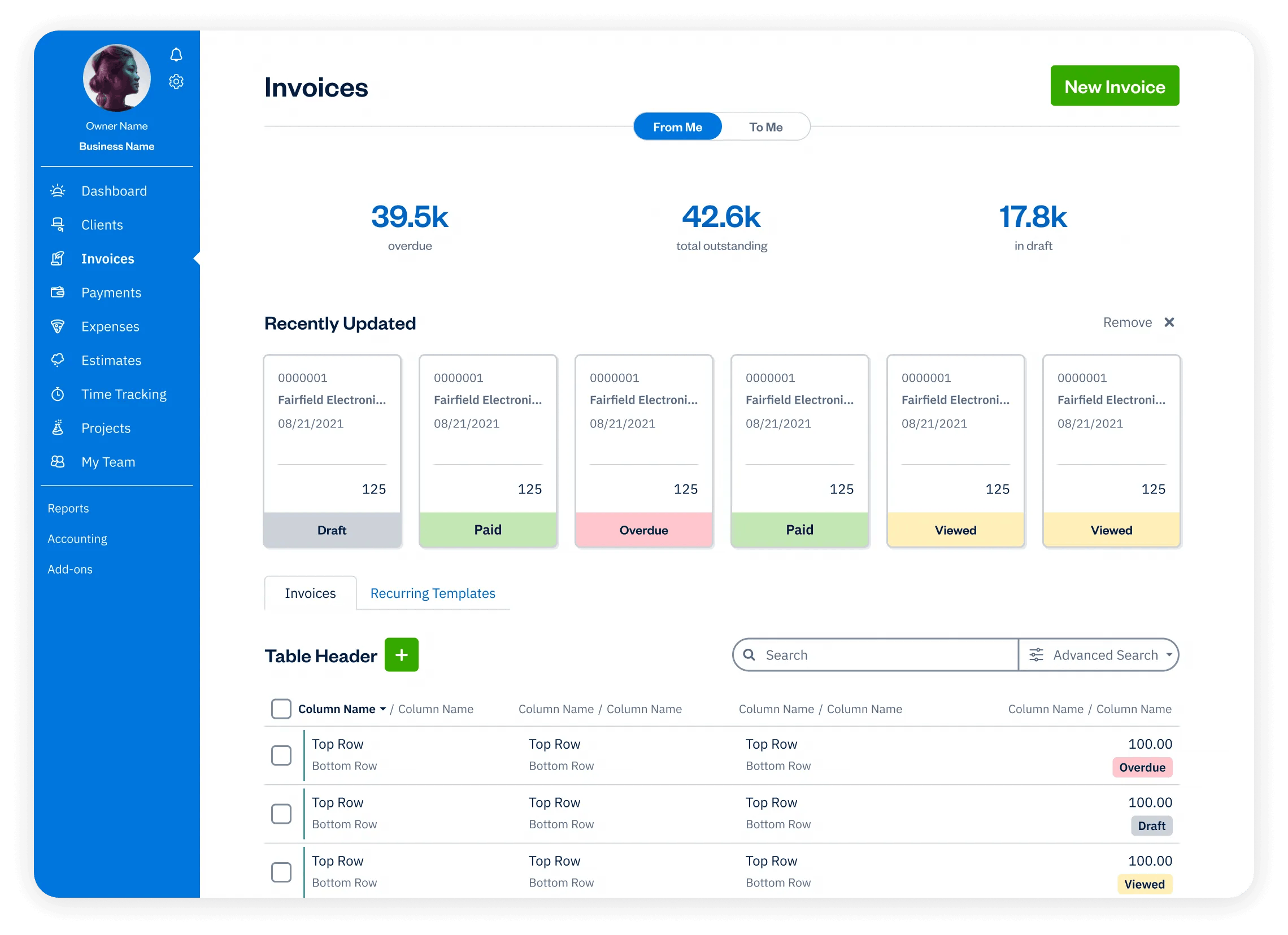

Invoices and client statements. You need simple, branded professional invoices that clients can understand. They should be clear about amounts owed, payment terms, and how to pay. If you offer good faith estimates or superbills, your system should track what’s been paid versus what’s outstanding.

Receipt capture. Snap photos of receipts with your phone and attach them to transactions. This creates an audit trail for the IRS and makes tax season less stressful. No more shoeboxes or missing documentation for tax deductions.

Accounts receivable tracking. If you bill insurance or offer payment plans, you need robust A/R reports. You should be able to see who owes what, how long balances have been outstanding, and which claims need follow-up when tracking client payments.

Basic reports. At minimum, you need Profit and Loss statements, Balance Sheets, and cash flow reports. A/R aging reports help if you bill insurance. These essential financial reports tell you whether your therapy practice is profitable, sustainable, and growing, helping you assess your practice’s financial health.

Therapy-specific needs

Your EHR should generate superbills and handle insurance claims. Your accounting software summarizes the financial totals. Keep the clinical work in clinical software and the money tracking in bookkeeping software.

Track no-show and late-cancel fees as separate income items so you can track income from these policies accurately. If you offer sliding scale rates, record discounts or write-offs transparently so your reports reflect true earned revenue versus adjustments.

Use classes, tracking categories, or tags to break down revenue by clinician or location. This helps in group practices where you need to see each therapist’s productivity or compare office locations as part of your practice management strategy.

HIPAA and ethics reality check

There is no HIPAA compliance guarantee in bookkeeping software because accounting tools aren’t designed to store protected health information. The solution is simple: keep PHI out of accounting entirely.

Use client IDs or initials on invoices and transaction memos. Never include diagnoses, CPT codes, treatment plans, or session notes. Generate superbills inside your EHR where they belong, then summarize totals in your bookkeeping system.

Sign Business Associate Agreements with your EHR vendor. Don’t store PHI in bookkeeping software, email threads, or spreadsheets. Enable multifactor authentication, set role-based permissions for staff access, and use automatic secure backups.

Top Accounting Software for Therapists in 2026

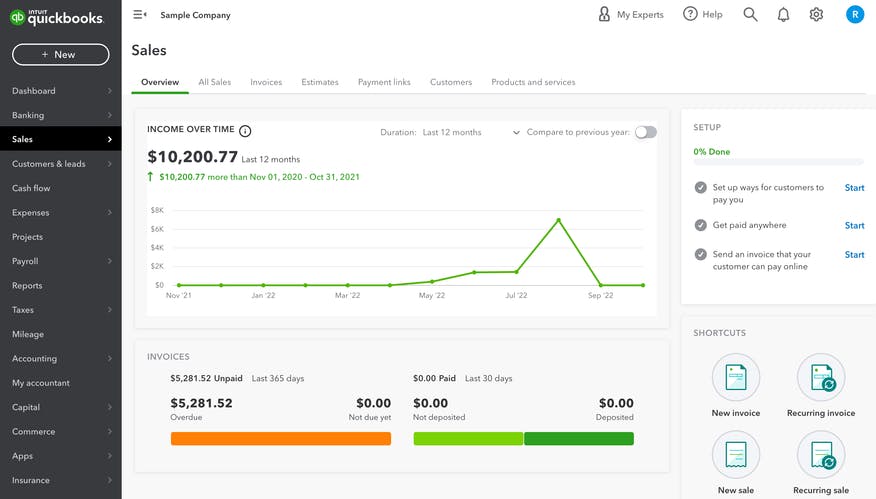

QuickBooks Online

Best for: Most solo and group practices.

Strengths:

- Powerful automation rules that learn your patterns and save time monthly

- Deep, flexible financial reports that CPAs appreciate and trust

- Widely supported by tax professionals across the country

- Robust app ecosystem for integrations with payroll processing, payment processing, and time tracking

- Strong accounts receivable features for insurance billing

Gaps:

- Steeper learning curve than simpler alternatives

- Pricing increases as you add features or users

- Interface can feel cluttered for simple cash-pay practices

Pricing: Plans commonly start around $20 per month, though promotional rates vary.

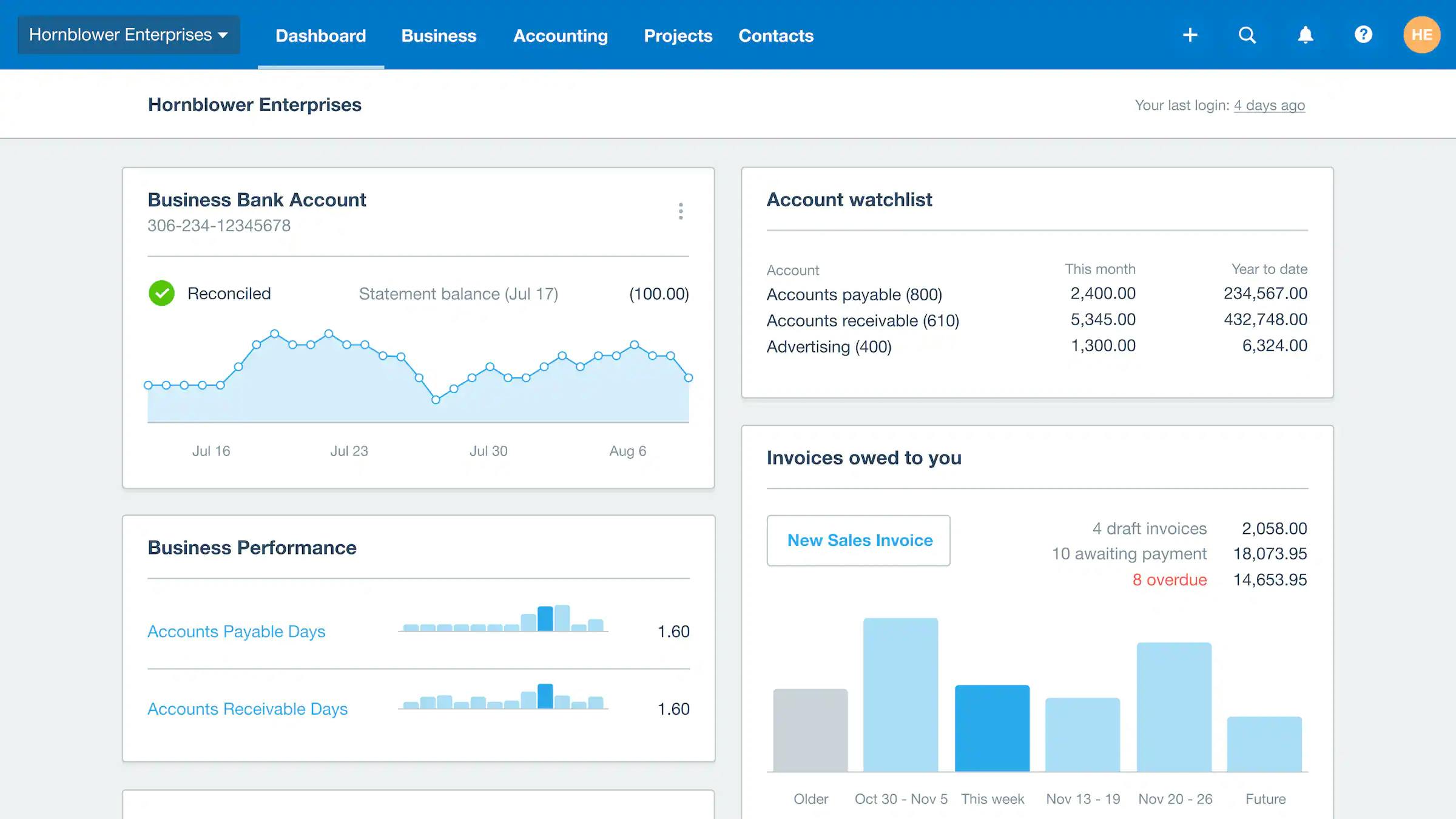

Xero

Best for: Group practices and teams needing unlimited users.

Strengths:

- Fast, intuitive bank reconciliation that feels effortless

- Clean, modern interface that’s pleasant to use

- Strong app marketplace with quality integrations

- Excellent collaboration features for multiple staff members

- Unlimited users on all plans

Gaps:

- US payroll requires Gusto integration rather than native tools

- Some CPAs prefer QuickBooks Online reports and workflows

- Slightly less robust app ecosystem in the US market

Pricing: Entry plans typically start around $15/$20 per month.

FreshBooks

Best for: Solo therapists who want simple invoicing and time tracking.

Strengths:

- Extremely intuitive interface with minimal learning curve

- Mobile-friendly for managing finances on the go

- Strong invoicing features with professional templates

- Good expense tracking and receipt capture

- Time tracking built in for consulting or supervision work

Gaps:

- Less robust for complex accounts receivable or insurance billing

- Multi-therapist reporting is limited compared to QuickBooks Online or Xero

- Fewer advanced automation features

Pricing: Often $19 to $60 per month for core tiers.

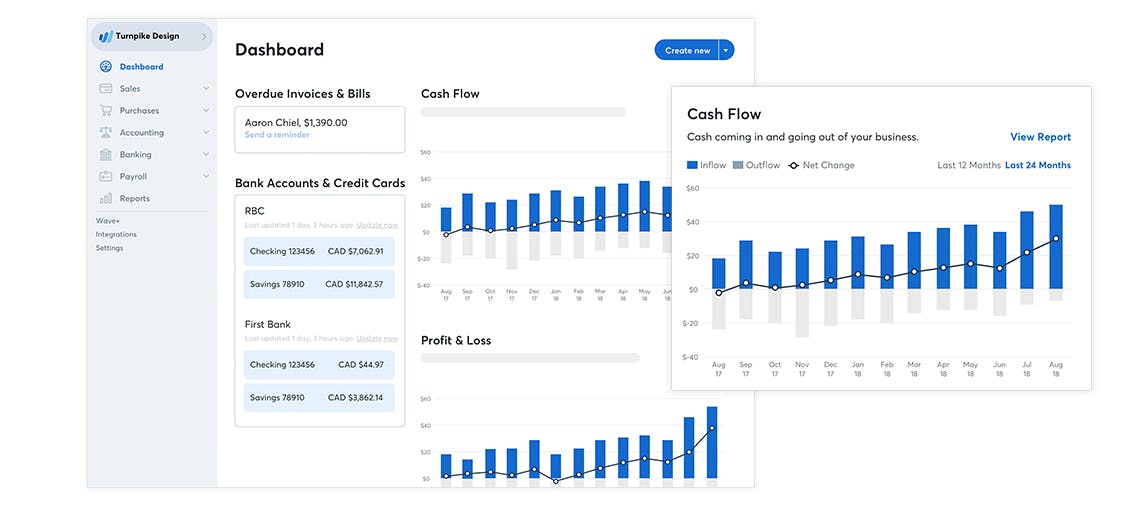

Wave

Best for: New practices with tight budgets.

Strengths:

- Core accounting features are completely free

- Simple invoicing and receipt scanning included

- Straightforward interface for basic bookkeeping tasks

- Good option while you’re building your private practice

- No credit card required to get started

Gaps:

- Limited scalability for growing or complex practices

- You’ll pay for payment processing and payroll services

- Fewer integrations and automation options

- Support is less comprehensive on free plans

Pricing: Core accounting is free.

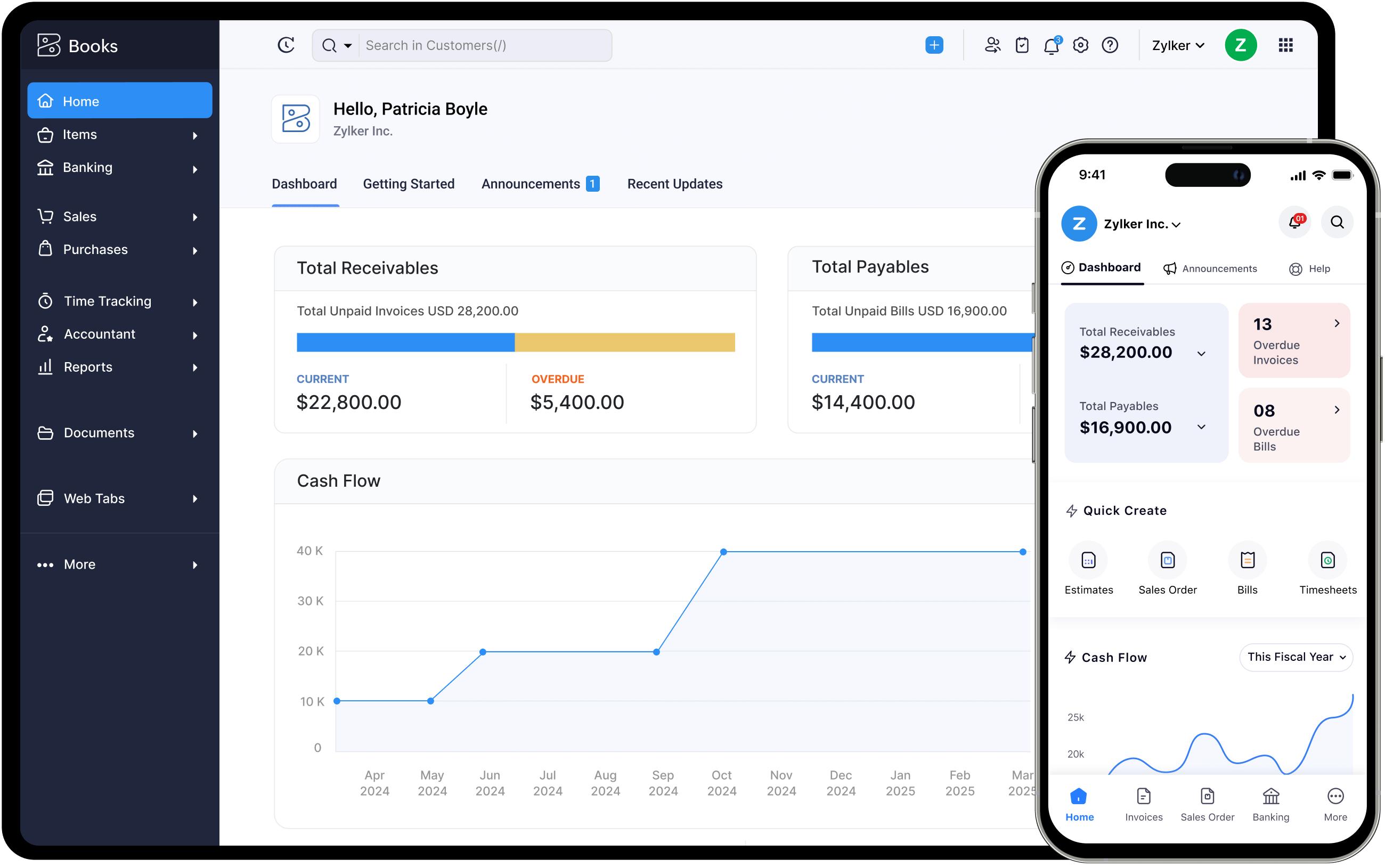

Zoho Books

Best for: Practices already using Zoho CRM or other Zoho apps.

Strengths:

- Strong automation capabilities and workflow rules

- Client portal for self-service access to invoices

- Good value for the feature set

- Integrates seamlessly with other Zoho products

Gaps:

- No therapy-specific features or templates

- Initial setup and customization can take time

- Less common among CPAs than QuickBooks Online

Pricing: Starts with a free plan. Entry plans commonly around $15 dollars per month.

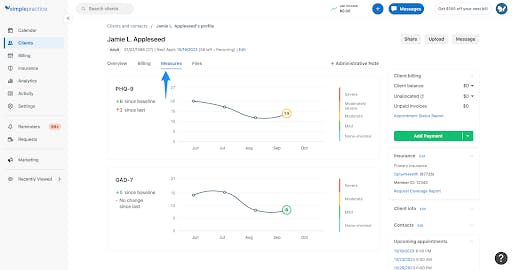

SimplePractice

Best for: Therapists who want EHR, scheduling, and billing in one place.

Strengths:

- Superbill generation and insurance claims in one system

- Integrated client portal and telehealth

- Payment processing built in

- Scheduling and clinical notes together

- Good for streamlining your entire practice workflow

Gaps:

- Not a full accounting system for tax preparation or detailed financial analysis

- Many practices still use QuickBooks Online or Xero alongside it for complete bookkeeping for therapists

- Financial reporting capabilities are more basic than dedicated accounting tools

Pricing: Starts around $49 per month for solo practitioners.

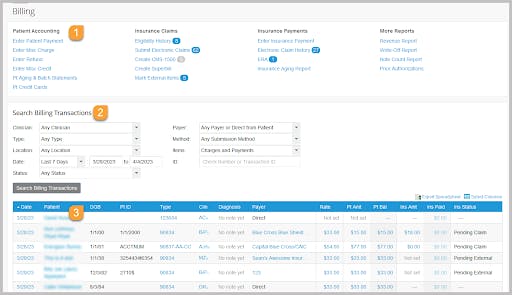

TherapyNotes

Best for: Practices that want strong documentation plus billing features.

Strengths:

- Insurance claims filing and ERA posting

- Integrated scheduling, notes, and billing

- Solid clinical documentation templates

- Good for insurance-heavy practices

Gaps:

- Financial reporting capabilities are basic for true accounting needs

- Most users still need separate software for therapists for tax prep

- Steeper learning curve than some alternatives

Pricing: 30-day free trial. Paid plans starting from $69/month

TherapyPartner

Best for: Practices wanting practice management tools plus financial tools in one platform.

Strengths:

- Scheduling and automated reminders

- Some accounting and financial tracking features

- All in one platform approach reduces the need to juggle multiple platforms

Gaps:

- Less flexible than standalone accounting tools

- Financial features are lighter than dedicated bookkeeping software

- Higher price point than basic options

Pricing: Pricing not publicly disclosed - contact vendor for custom quote

Patriot Accounting

Best for: Budget-conscious practices that are cash-pay and simple.

Strengths:

- Very affordable pricing

- Straightforward interface without complexity

- Good for basic income and expense tracking

Gaps:

- Fewer integrations with other tools

- Limited advanced reporting features

- Less common among accounting professionals

Pricing: 30-day free trial. Starts around $20 per month.

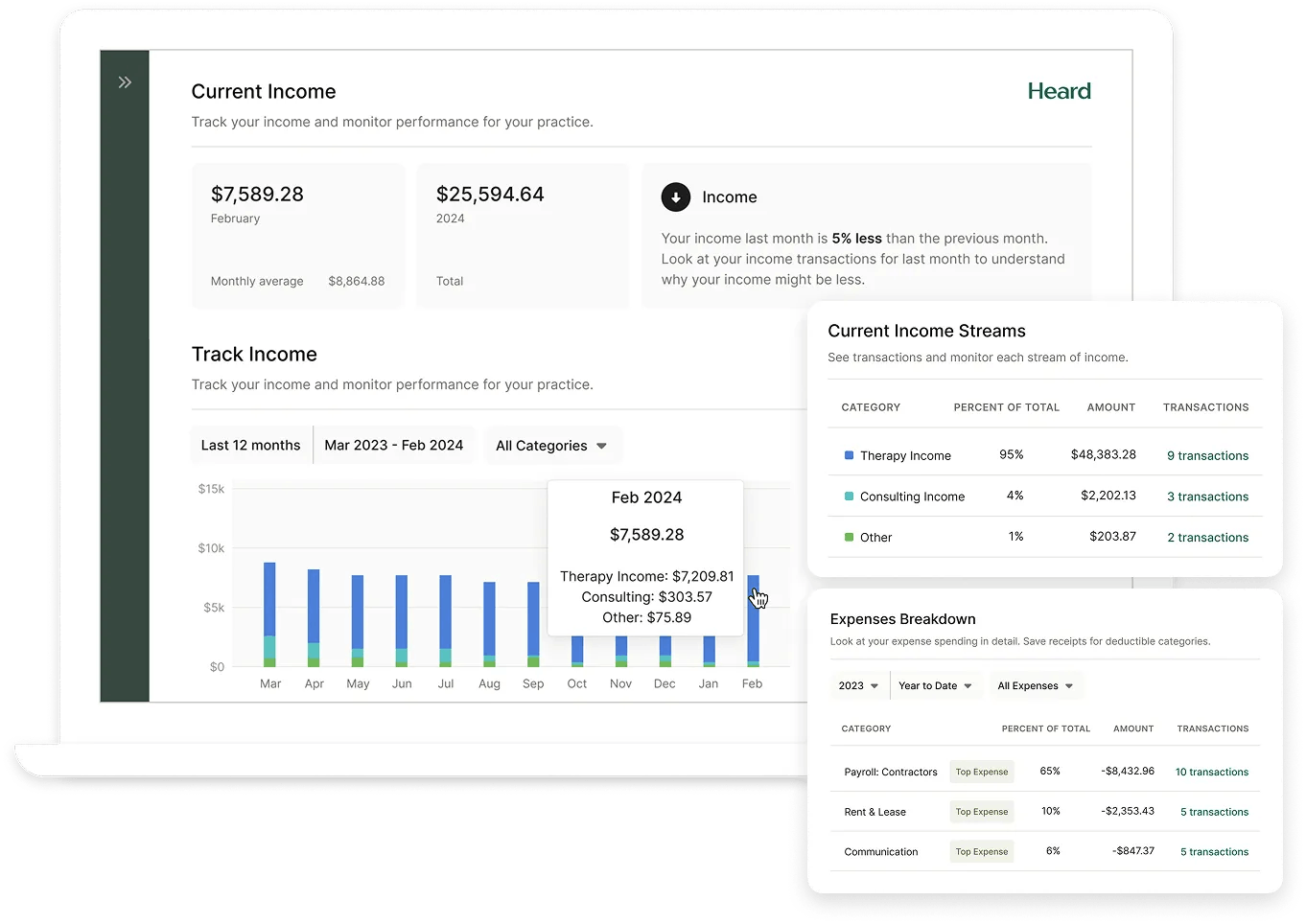

Heard

What it is: Outsourced bookkeeping, tax filing, and payroll services built specifically for therapists.

Best for: Mental health professionals who want expert support and less administrative tasks.

Strengths:

- Specialized knowledge of therapy practice finances

- Monthly financial reports prepared for you

- Tax estimates and quarterly tax filing support

- S corp election guidance and compliance

- Reduces your admin burden significantly

Gaps:

- Higher monthly cost than DIY software alone

- Not a self-service accounting app

- You’re dependent on their team and timeline

Pricing: Pricing not publicly disclosed

How to choose among these

If you work with a CPA, ask what software they support and prefer. Their familiarity will save you money on accounting fees and reduce friction during tax season.

Match the tool’s complexity and growth potential to your practice reality. Start simple if you’re solo and cash-pay. Choose more robust options if you bill insurance or manage multiple clinicians. Avoid vendor lock-in by picking tools with good data export options.

Check integrations carefully with your EHR, payment processor, and payroll provider. Automation between systems saves far more time than any single tool’s features and helps streamline key financial tasks.

Integrations That Matter for Therapists

EHR and billing

Use your EHR for scheduling, clinical documentation, insurance claims, and superbill generation. This is where PHI lives and stays. Export monthly financial summaries to your bookkeeping software as simple totals without any clinical details or other financial data.

Popular EHRs like SimplePractice, TherapyNotes, and TheraNest can export payment data. Import these summaries to match against bank deposits and track accounts receivable as part of your billing process.

Payment processing

Most therapists use Stripe, Square, or integrated payment processing through their EHR. Map these deposits correctly in your bookkeeping software to avoid duplicate income when payouts are batched over several days. Many systems also let you accept online payments and process credit card transactions seamlessly.

Use bank rules to automatically split out processing fees as expenses. This keeps your income accurate and your fee expenses categorized properly for tax deductible purposes.

Payroll

Use Gusto, QuickBooks Payroll, or ADP if you have W-2 employees. Set up 1099 contractor payments for associate therapists if that matches your practice structure. Automate payroll tax calculations and government filings to stay compliant without manual work, and consider tracking retirement contributions within your system.

Document capture and storage

Use receipt capture tools built into your accounting app or add-ons like Dext or Hubdoc. Snap photos of receipts immediately and attach them to transactions. Never store PHI in receipt notes or attachments. Keep clinical and financial records completely separate.

Security, Ethics, and HIPAA in Accounting Workflows

Minimize PHI exposure

Never include diagnoses, CPT codes, treatment plans, or session notes in your bookkeeping system. Use client IDs or neutral identifiers like initials. When possible, keep client names out of transaction memos entirely.

Generate all superbills inside your HIPAA-compliant EHR. Export only summary financial data to bookkeeping software: date, amount, payment method. Nothing clinical crosses that boundary, protecting both HIPAA compliance and your practice’s finances.

Controls and access

Enable multifactor authentication for every user who accesses your bookkeeping software. Set role-based permissions so bookkeepers can’t see everything owners can, and staff only see what they need.

Review audit logs quarterly to catch any unusual access patterns or unauthorized changes. Most quality accounting software tracks who changed what and when.

Backups and retention

Use automatic cloud backups that your bookkeeping software provides. Export monthly financial statements as both PDF and CSV files for redundancy. Store these exports in a secure location separate from your primary software.

Create a simple data retention policy. Typically you’ll keep financial records for seven years to match IRS audit timelines. Document your policy and follow it consistently.

Quick Picks: Best Accounting Software for Therapists by Scenario

Solo, mostly private pay

Best: FreshBooks or Wave.

Why: Simple invoicing, receipt capture, and easy expense categorization without unnecessary complexity, perfect for managing a private practice.

Watch out: Limited advanced reporting as your practice grows or becomes more complex.

Solo, heavy insurance billing

Best: QuickBooks Online paired with your EHR.

Why: Strong accounts receivable tracking, accountant-friendly reports, and robust aging reports for claims management help you track income effectively.

Watch out: Keep PHI completely out of accounting. Use client IDs only, never clinical details.

Growing group practice

Best: QuickBooks Online or Xero.

Why: Multi-user access without extra fees, robust reporting, class tracking by clinician, and strong payroll integrations help you manage your growing practice’s financial health.

Watch out: Create classes or tracking categories early for each clinician or location so you can analyze productivity and generate financial reports by segment.

New practice with zero software budget

Best: Wave.

Why: Free core accounting features let you track income and track expenses properly from day one. Pay only for payment processing and payroll when you need them.

Watch out: You may outgrow Wave’s capabilities as your practice becomes more complex and requires more comprehensive reporting.

Needs strong collaboration with CPA

Best: QuickBooks Online.

Why: Most CPAs are fluent in QuickBooks Online, making shared access and collaboration effortless. Strong audit trail and accountant-friendly reports streamline tax prep.

Watch out: Bank rules and automation reduce manual work significantly, so invest time in setup to save time later.

Wants to outsource the finance work

Best: Heard (outsourced bookkeeping, tax prep, and payroll).

Why: Built specifically for mental health professionals. Reduces your admin burden dramatically and provides expert guidance on therapy practice finances while handling essential financial tasks.

Watch out: Higher monthly cost than DIY software, but may be worth it for peace of mind and time saved.

Set Up Your Accounting Software: A Therapist’s Checklist

Chart of accounts tailored for therapy

Build your chart of accounts around how therapy practices actually work:

Keep it simple. You only need categories that reflect how money moves in and out of your practice.

Income

- Therapy sessions (individual, couples, family)

- Group therapy or workshops

- Assessments or testing

- No-show and late-cancel fees

- Supervision or consulting work

Direct Costs

- Associate therapist payments or contractor fees

- Testing materials or assessment tools

- Client-related supplies (e.g., worksheets, handouts)

Expenses

- Office rent or telehealth subscriptions

- EHR/practice management software

- CEUs, licensure renewals, memberships

- Malpractice insurance

- Marketing and website costs

- Payment processing fees

- Office supplies, phone, and internet

- Travel or mileage

- Payroll and taxes (if applicable)

Equity & Taxes

- Owner draws or distributions

- Retained earnings

- Estimated tax payments

Connect and clean

Connect your business bank accounts and credit cards to start importing transactions automatically. Import the last 90 days of transactions to get a running start.

Set up bank rules for common vendors and regular payouts from payment processors. This automation will save you hours every month once it’s configured properly and helps you track expenses consistently.

Enter accurate opening balances as of your start date and clear any duplicate transactions. A clean start prevents reconciliation headaches later.

Invoice and item setup

Create service items for each type of session or service you offer: individual therapy, couples sessions, groups, assessments, no-show fees. Use neutral, professional labels that don’t include PHI.

Customize invoice templates to show only client IDs or initials, never names when possible. Include clear payment terms and instructions. Make invoices easy for clients to understand and act on. Consider enabling automated invoicing for recurring billing arrangements.

Collaboration and workflow

Invite your CPA or bookkeeper with appropriate permission levels. They should see what they need without accessing everything. Document your monthly close checklist including reconciliation deadlines and review dates.

Set up a simple monthly workflow: reconcile accounts, review uncategorized transactions, generate financial reports, and check A/R aging. Consistency beats perfection. This regular attention to bookkeeping tasks ensures your practice’s financial health stays clear.

Cost and ROI: Do the Math

Typical monthly costs

Understanding the investment helps you choose the best bookkeeping software wisely:

- QuickBooks Online: Often $25 to $90 depending on plan and features

- Xero: Often $15 to $78 depending on plan level

- FreshBooks: Often $17 to $60 depending on tier and user count

- Wave: Free core accounting, fees apply for payment processing and payroll

- EHRs with billing features: Commonly $29 to $99 per clinician per month

Beware of hidden costs like payment processing fees or charges for third party apps that extend functionality.

Simple ROI example

If accounting software saves you just two hours per week and your effective hourly rate is $120, that’s $240 of time saved weekly. Over a month, that’s nearly $1,000 in time value.

Even a $50 monthly software subscription pays for itself many times over. The real question isn’t whether you can afford it. It’s whether you can afford not to use it to save time and improve your financial health.

When to Hire a Bookkeeper or CPA

Signals you’re ready

You consistently avoid looking at your books because bookkeeping tasks feel overwhelming. Reconciliations fall weeks or months behind. You’re not sure whether your practice is actually profitable or what your financial health looks like.

Your annual revenue exceeds $100,000 or you’ve added associate clinicians. Managing payroll, contractor payments, and multiple income streams becomes complex quickly and requires attention to key financial tasks.

You accept insurance and have persistent accounts receivable that needs regular attention. Or you’re considering S corporation election for tax savings but don’t understand the compliance requirements, which is a critical aspect of practice management.

What they do for you

A good bookkeeper handles monthly reconciliations and generates clean financial reports. They catch errors early and keep your books audit-ready. CPAs provide quarterly tax planning, calculate estimated payments, and handle year-end close and tax returns, making tax season smoother.

They also set up and manage payroll properly, ensuring compliance with tax withholding and reporting requirements. This expertise prevents costly mistakes and penalties. They can offer valuable insights into improving cash flow and provide financial planning guidance.

How software helps the relationship

Invite your bookkeeper or CPA as a user in your bookkeeping software with appropriately limited permissions. Use shared monthly close checklists so everyone knows what’s expected and when.

Keep communication inside the app through notes and attachments when possible. This creates a clear audit trail and reduces scattered email threads. The right accounting software creates a foundation for collaboration with financial professionals.

Migration Tips and Common Mistakes

Move off spreadsheets

Pick a clean start date, typically the first day of a month or quarter. Enter opening balances for all accounts as of the day before your start date. Import the last 90 days of bank transactions and reconcile them carefully.

Archive your old spreadsheet but keep it read-only for reference. Don’t try to recreate years of history. A clean start beats perfect historical data and gives you a fresh bookkeeping system.

Avoid these errors

Never mix personal and business expenses in the same bank accounts or software. Commingling funds creates tax headaches and pierces liability protection for private practice owners.

Watch for duplicate income when payment processors batch deposits. If your EHR records a $150 session and your bank shows a $150 deposit, record client payments once, not twice.

Don’t leave expenses uncategorized. Your reports are only as good as your categorization. Set aside time monthly to clean up and categorize everything properly to track expenses accurately.

Set aside money for quarterly taxes every month, typically 25-30% of net income for solo practitioners. Estimated taxes are due quarterly and surprise tax bills damage your cash flow management.

Never store PHI in accounting notes, attachments, or anywhere in your financial software. This bears repeating because it’s both an ethical requirement and a practical necessity for mental health professionals.

Buyer’s Checklist for Accounting Software for Therapists

Use this checklist when evaluating the best accounting software options:

Must-have features:

- Bank feeds with automatic transaction imports

- Rules and automation for recurring transactions

- Receipt capture via mobile app for expense tracking

- Simple invoicing with customizable templates

- Accounts receivable tracking and aging reports

- Essential financial reports: P&L, Balance Sheet, cash flow

- Easy CPA access with appropriate permissions

- Clean data export options

Therapy practice fit:

- Classes or tags for tracking by clinician or location

- Handles your payment processor’s deposit structure

- Integrates with your EHR or practice management software through direct integration or compatible workflows

- Works with your payroll provider

- Scales to your growth plans without excessive cost jumps

Security and compliance:

- Multifactor authentication for all users

- Role-based permission controls

- Robust audit logs

- Automatic secure backups

- Clear data ownership and export policies

Practical considerations:

- Transparent pricing you can afford long-term

- Learning curve matches your technical comfort

- Support quality and responsiveness

- Your CPA’s preference and familiarity

- Choosing the right bookkeeping software depends on your specific practice needs

Conclusion

Choose accounting software that fits your current practice reality, not some imagined future state. You can always upgrade later. Keep PHI completely in your EHR, never in accounting systems. This boundary protects your clients and simplifies your compliance.

Build a simple monthly workflow and stick to it. Reconcile on time, categorize expenses properly, and review key metrics regularly. If you feel stuck or chronically behind, bring in a bookkeeper or CPA. Their expertise pays for itself quickly and provides financial insights.

Good financial management supports good clinical work. It protects your focus, your time, and your peace of mind. When your finances are organized and clear, you can return your attention to what matters most: your clients and your clinical work. The right bookkeeping software enables you to make informed financial decisions and maintain your practice’s financial health with confidence.

Frequently Asked Questions

Q. Do I need different accounting software if I bill insurance versus cash-pay only?

Not necessarily different software, but you need stronger accounts receivable features if you bill insurance. QuickBooks Online and Xero handle A/R well. Cash-pay practices can succeed with simpler tools like FreshBooks or Wave.

The key is tracking client payments, what’s owed versus what’s paid, which matters much more with insurance’s longer payment cycles. The best accounting software for your practice depends on your billing model.

Q. Can I use the same software for both my therapy practice and another business?

Technically yes, but it’s cleaner to separate them. Most bookkeeping software allows multiple companies under one login. Separate books make taxes simpler, protect liability separation, and clarify each business’s profitability.

If you do combine them, use classes or locations to track each business separately, similar to how small business owners manage multiple ventures.

Q. How do I handle client payments that my EHR already tracks?

Your EHR tracks client billing and billing details with PHI. Your bookkeeping software tracks money movement without PHI. Export summary financial data from your EHR monthly and import it to accounting as simple totals.

Match these against actual bank deposits. The systems work together but serve different purposes with different privacy requirements.

Q. What’s the difference between bookkeeping software and accounting software?

These terms are often used interchangeably. Bookkeeping typically means recording transactions, while accounting includes analysis and reporting. For therapists, both functions usually happen in one tool.

You’re recording income and expenses (bookkeeping) and generating Profit and Loss statements (accounting). Modern software does both, providing comprehensive reporting.

Q. Should I do my own books or hire someone from day one?

Start by doing your own books if your practice is simple and solo. You’ll understand your finances better and save money while building.

Hire help when you’re avoiding the work, falling behind, or your practice grows complex. Most solo therapists can self-manage until they hit $75,000-$100,000 in annual revenue. Consider outsourced bookkeeping at that point.

Q. How do I categorize expenses that are partially personal and partially business?

Only the business portion represents tax deductible expenses. For items like your phone or internet, calculate the business percentage and expense only that amount.

For office rent if working from home, use the simplified method or actual expense method following IRS guidelines. When in doubt, ask your CPA. Proper documentation matters if you’re audited.

Q. Can I switch accounting software mid-year or should I wait?

You can switch anytime, but month-end or quarter-end makes reconciliation cleaner. Export all your data from the old system first.

Enter opening balances in the new system as of your switch date. Don’t try to migrate full transaction history unless absolutely necessary. Your old software remains accessible for historical reference.

Q. What reports should I actually look at monthly?

At minimum, review your Profit and Loss statements to see income minus expenses and whether you’re profitable. Check your Balance Sheet to understand assets, liabilities, and equity. If you bill insurance, review your A/R Aging report to catch overdue claims.

Cash flow statements help if you experience seasonal fluctuations or payment timing gaps. These essential financial reports provide valuable insights into your practice’s finances and support cash flow management.

Q. Do I need to keep paper receipts if I’ve captured them digitally?

The IRS accepts digital copies if they’re clear and complete. Snap photos immediately and attach them to transactions. Back up your accounting data regularly.

Many therapists discard paper after scanning, but check with your CPA about your specific risk tolerance and practice type. This is a critical aspect of maintaining financial records.

Q. How do I know if I should elect S corporation status?

Consider S corp when your practice nets more than $60,000-$80,000 annually and you can justify a reasonable salary. S corps offer tax savings by splitting income between salary and distributions, but add compliance complexity and costs.

Talk to a CPA who understands therapy practices. Wrong timing or structure can cost more than you save. This is one area where financial planning expertise matters significantly.